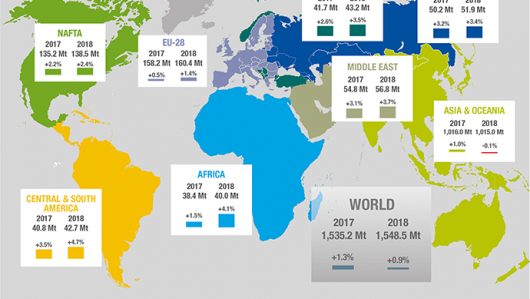

Commenting on the outlook, Mr. TV Narendran, Chairman of the World Economic Committee, said, "2016, steel demand recovery stronger than expected with the increasing trend mainly from China. We believe in 2017 and 2018, we will see an increase in cyclical demand for steel to recover the continuity of the economic development and the rapid growth in the economy, emerging and developing. We hope that Russia and Brazil will eventually come out of recession. However, China, accounting for 45% of global steel demand, is expected to return to growth slowing after the recent short-term increase. For this reason, the overall growth momentum will remain modest.

The global economy is growing, but the uncertainty escalates

With the risk of a global recession is reducing and improving the economic situation in most of the region, a number of geopolitical change has created some concern. Policies of the US uncertain, United Kingdom and Gibraltar European Union membership referendum, waves of population is increasing in the elections in Europe today and the potential retreat from globalization and free trade under the pressure of nationalism growing, adding a new dimension of uncertainty in the investment environment.

Oil and other commodities

Rising oil prices in 2016 helped financial position of oil producers. In the 2017-18 year, oil prices are expected to achieve moderate growth, but growth in 2010-12 seems impossible that despite recent OPEC agreement to cut oil production. Prices of other commodities also rebounded thanks to stronger activity in China, but is not likely to increase further. Oil prices rose slightly can stimulate investment in the economy worldwide.

Automotive industry will decelerate, but the construction industry may increase

The automotive industry has become the sector leader in the steel using sectors key thanks to the recovery of consumption in the economy development, low oil prices and the stimulus program of government assistance to buy cell Cars in a number of countries. However, this may be approaching a peak.

The construction industry, housing and infrastructure, accounting for 50% of global steel output, showed a picture divided among the developing economies and development. This sector has become the main driver for steel demand in developing country towards urbanization, but activity in the developed economies since the financial crisis in 2008 has decreased. This seems to change with the recovery in construction activity in the EU through clear economic conditions improved and the innovation potential of the infrastructure in the US.

China slowdown

Program reform and rebalancing of the Chinese economy continued in the first half 2016, interrupted only by small stimulus measures by the government to reduce the rate of degradation. This has created a short-term boom in investment in infrastructure and housing markets, stimulating demand for steel and other commodities. The result is that China's steel demand grew by 1.3% in 2016. Although China's economic outlook seems stable and steel demand continues to remain high in early 2017, is expected will gradually slow down as the government tried to tighten the real estate policy.

China's steel demand is expected to remain in 2017 and then decreased by -2% in 2018.

Developing world

Benefit from the fundamentals strong, the new measures to be announced related to fiscal stimulus and rising cost of infrastructure, the US is expected to continue to lead the growth in the country development in the year 2017-18.

The recovery of the EU is a firm with many positive developments. Eurozone monetary policy is expected to continue on its current path, at least until 2017, while fiscal tightening will not be increased further and the risk of deflation has decreased significantly. If political stability can be maintained, the investment is expected to rise increasing push for the restoration. Benefit from the development of the global economy and a weaker yen, Japan's steel demand is expected to recover stability.

Steel demand in the developed economies will grow 0.7% in 2017 and 1.2% in 2018.

Developing world

After solving structural problems and falling commodity prices, Russia and Brazil's economy is stabilizing and is expected to grow modestly in 2017. Growth in Russia will continue to increase in 2018 as wealth how to structure more effective. ASEAN countries are expected to grow steadily in the years 2017-18. However, the region remains vulnerable because of currency fluctuations related to the increase in US interest rates and the dollar rose.

Steel demand in emerging economies and developing countries, excluding China, accounting for 30% of the world, is expected to grow 4.0% in 2017 and 4.9% in 2018.

(Worldsteel 21/4/2017)